Potential Gross Return: 6.8%

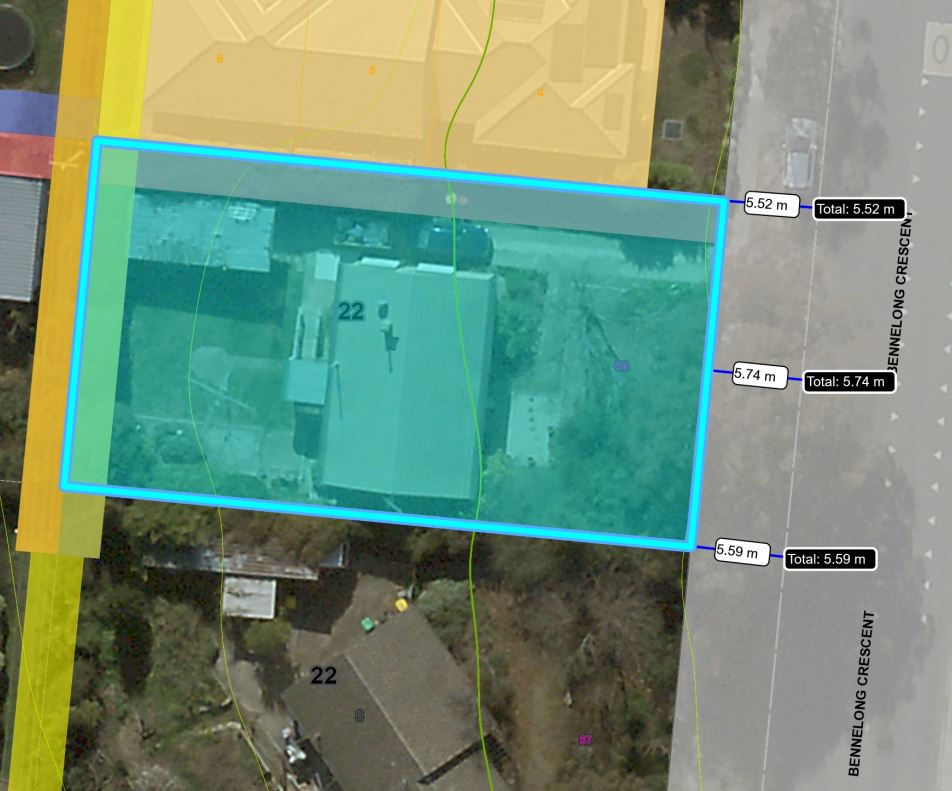

Address: 69 Bennelong Crescent Macquarie, ACT 2614

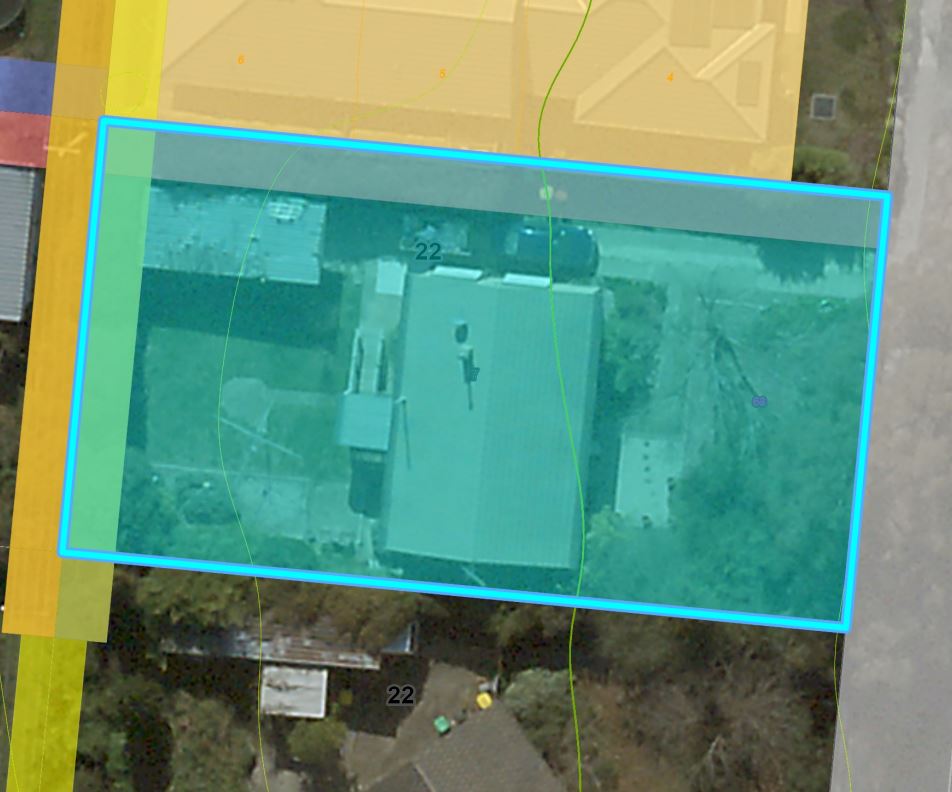

Block-Size: 736 sqm

Block: 7

Section: 22

Type: House

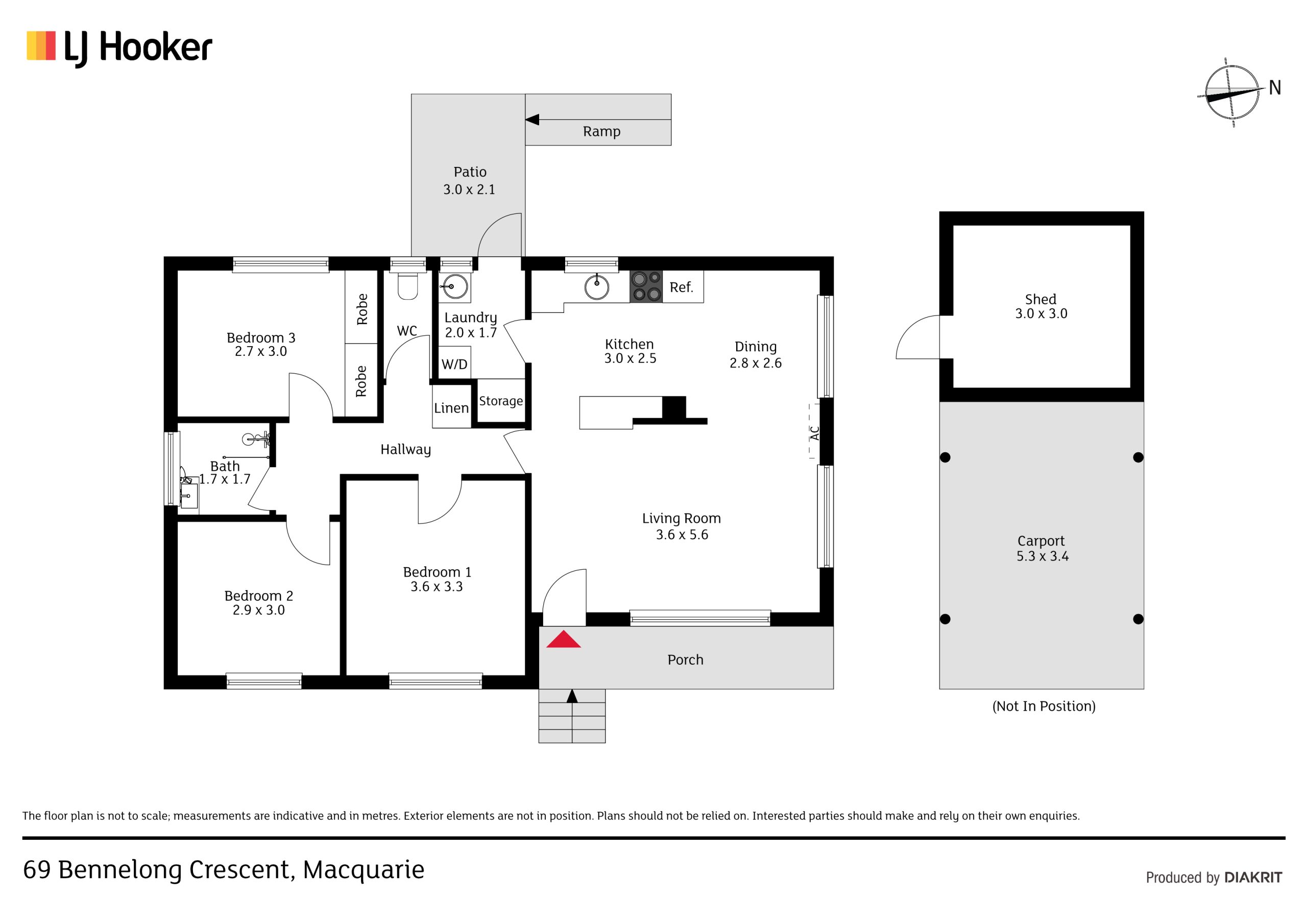

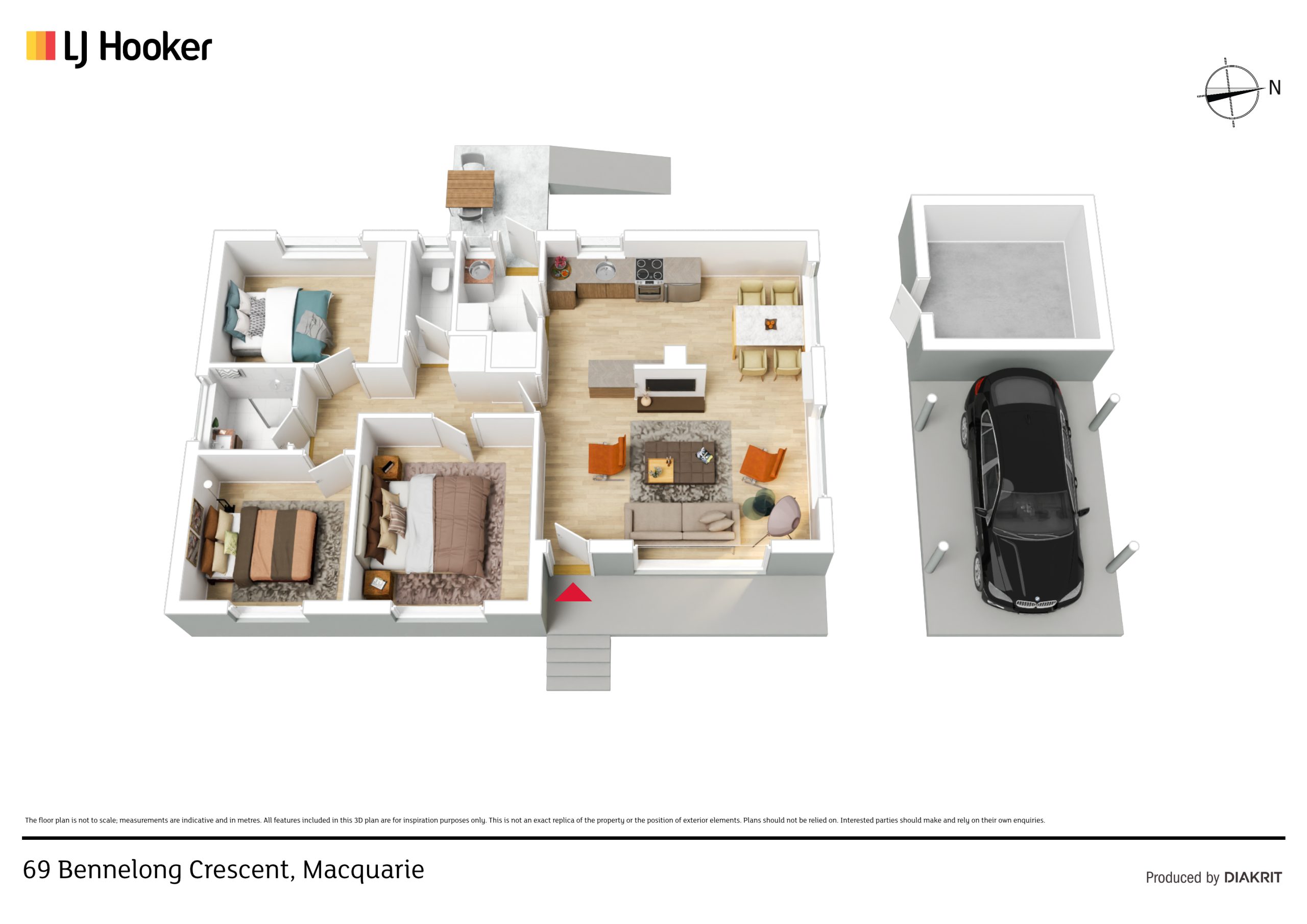

House/Building Size: TBC

Bedrooms: 3

Bathrooms: 1

Garaging/Car Spots: 1

EER: 1.0

Unimproved Value (2022): $761,000 (2022)

UV Price Ratio: 95.13%

Sales Method: $795,000 (Private Treaty)

Recommend Purchase Price: $800,000

Rates Residential 2022: $3,609*

Land Tax Residential 2022: $5,940*

Property Link: https://zango.com.au/sale/69-bennelong-crescent-macquarie-act-2614-73187/

Marketing Agent: Troy Thompson and Olivia Fairweather

Date Added: 08/02/2023

Block Details:

Block Size: 736 sqm

Block Type: Large Block

Zoning: RZ2: SUBURBAN CORE

Frontage Approx:

Precinct Code: 69 Bennelong Crescent Macquarie, ACT 2614 Precinct Code Download

Heritage: N/A

Planning Assessment Report: PAR - 69 Bennelong Crescent Macquarie, ACT 2614

Suburb Information:

Median House Price (2022): $1,095,000

Median House Rent (2022): $730

Suburb Highest Price (2022): $1,637,000

Rental Vacancy Rate (2022): 0.60%

Medium Household Income (Census 2021): $1,947

Income to Rent Ratio: 37%

Download Suburb Profile: Macquarie Profile - February 2023

Property Purchase Recommendation Summary:

Recommend Purchase Price: $800,000

Estimated Stamp Duty: $28,150

Approx Legal and Building Report Costs: $3,000

Total Purchase Investment: $828,150

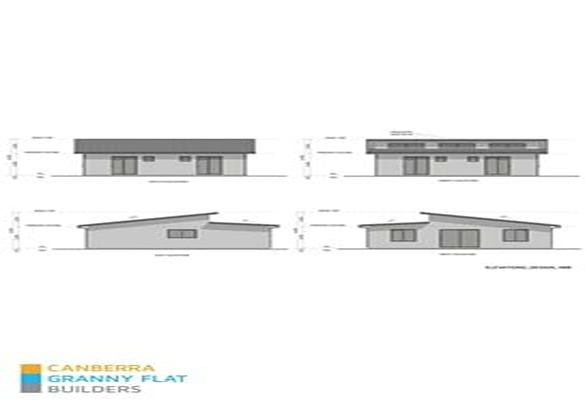

Recommended Secondary Residence:

Recommended Secondary Residence: https://www.canberragrannyflatbuilders.com.au/design-pages/design-488

Approx Turnkey Build Cost inc GST: $375,000

Downloadable Brochure: Design Brochure - 488

Potential Rental Income:

Rental Income Stratgety:

Potential Gross Weekly Rental Income of Existing Property: $575

Potential Gross Weekly Rental Income of Recommended Design: $1,000

Potential Combined Gross Weekly Income: $1,575

Potential Combined Gross Annual Income: $81,900

Financial Summary:

Total Purchase and Build Investment: $1203150

Potential Combined Gross Rental Annual Income: $81,900

Potential Gross % Return: 6.8%

0 comments