Potential Gross Return: 5.4%

Address: 24 Clifford Crescent, Melba ACT 2615

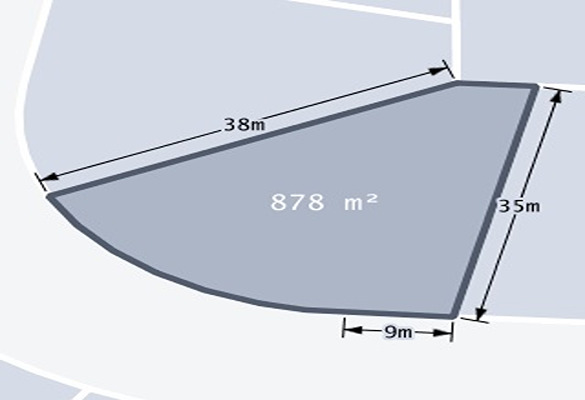

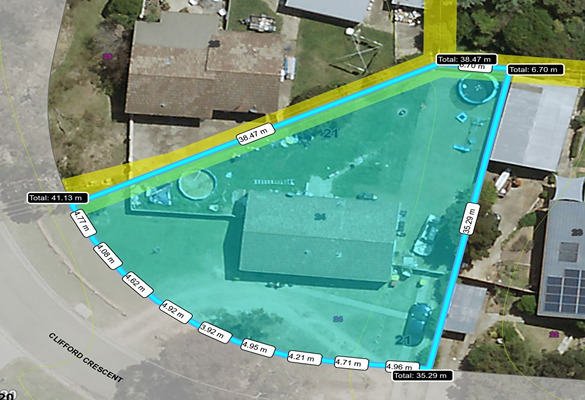

Block-Size: 877 sqm

Block: 24

Section: 21

Type: House

House/Building Size: TBC

Bedrooms: 3

Bathrooms: 1

Garaging/Car Spots:

EER: 1.0

Unimproved Value (2022): $544,000 (2022)

UV Price Ratio: 78.84%

Sales Method: $690,000 (Private Treaty)

Recommend Purchase Price: $690,000

Rates Residential 2022: $2,792*

Land Tax Residential 2022: $4,258*

Property Link: https://zango.com.au/sale/24-clifford-crescent-melba-act-2615-70889/

Marketing Agent: Maree Van Arkel and Megan Van Arkel

Date Added: 12/01/2023

Block Details:

Block Size: 877 sqm

Block Type: Large Block

Zoning: RZ1: SUBURBAN

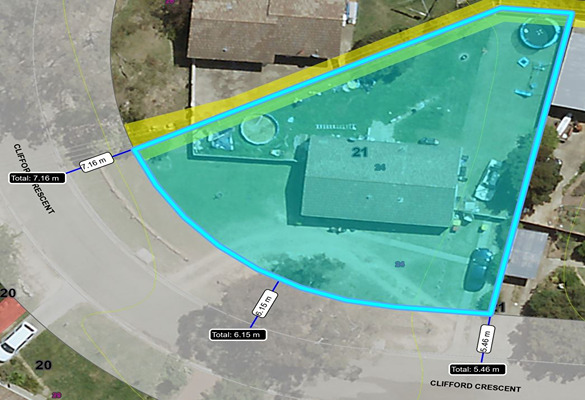

Frontage Approx:

Precinct Code: 24 Clifford Crescent, Melba ACT 2615 Precinct Code Download

Heritage: N/A

Planning Assessment Report: PAR - 24 Clifford Crescent, Melba ACT 2615

Suburb Information:

Median House Price (2022): $1,005,000

Median House Rent (2022): $710

Suburb Highest Price (2022): $1,270,000

Rental Vacancy Rate (2022): 0.47%

Medium Household Income (Census 2021): $2,326

Income to Rent Ratio: 31%

Download Suburb Profile: Melba Profile - January 2023

Property Purchase Recommendation Summary:

Recommend Purchase Price: $690,000

Estimated Stamp Duty: $22,608

Approx Legal and Building Report Costs: $3,000

Total Purchase Investment: $712,608

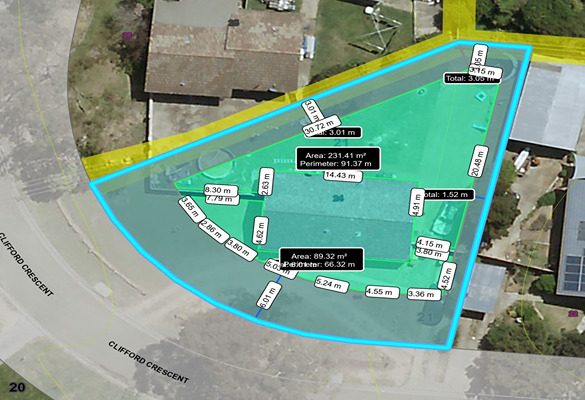

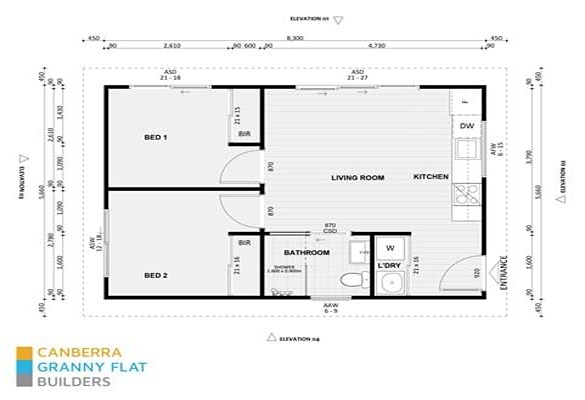

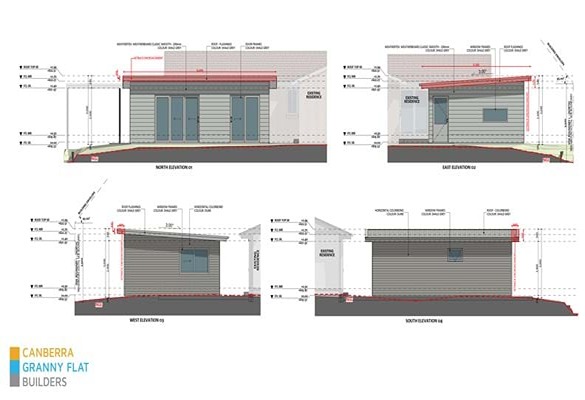

Recommended Secondary Residence:

Recommended Secondary Residence: https://www.canberragrannyflatbuilders.com.au/design-pages/design-256

Approx Turnkey Build Cost inc GST: $250,000

Downloadable Brochure: Design Brochure - 256

Potential Rental Income:

Rental Income Stratgety:

Potential Gross Weekly Rental Income of Existing Property: $500

Potential Gross Weekly Rental Income of Recommended Design: $500

Potential Combined Gross Weekly Income: $1,000

Potential Combined Gross Annual Income: $52,000

Financial Summary:

Total Purchase and Build Investment: $962608

Potential Combined Gross Rental Annual Income: $52,000

Potential Gross % Return: 5.4%

0 comments